Sensible Tax Reform--Simple, Just and Effective

D. FAQs: Impact upon Individuals

| (1) Sensible Tax Reform primarily relies upon a federal consumption tax. Why is an income tax also part of STR? |

| (2) What is the personal income-tax component of Sensible Tax Reform? |

| (3) What counts as taxable income under Sensible Tax Reform? |

| (4) Under existing tax rules, dividends and capital gains are taxed at no more than half the tax rate that applies to other sources of income. Why will they not be given the same preferential treatment under Sensible Tax Reform? |

| (5) How is the withdrawal of savings treated under Sensible Tax Reform? |

| (6) How would Sensible Tax Reform affect deductions for mortgage interest payments and property taxes? |

| (7) How would Sensible Tax Reform affect tax credits? |

| (8) What would our income-tax compliance obligation be under Sensible Tax Reform? |

| (9) What would the income-tax rates be under Sensible Tax Reform? |

| (10) Some individual are able to borrow money to spend. How would that be taxed? |

| (11) How would illegal activities be affected by Sensible Tax Reform? |

(1) Sensible Tax Reform primarily relies upon a federal consumption tax.

Why is an income tax also part of STR?

Sensible Tax Reform is not simply a proposal for shifting the American federal tax system to a federal consumption tax (FCT). Rather, it is a comprehensive tax plan that eliminates most current federal taxes (e.g., Social Security, Medicare, estate, alternative minimum, business income, and most personal-income taxes). Its principal source of replacement income will indeed be the federal consumption tax. However, an FCT alone will not be sufficient.

Taxing consumption alone has several serious flaws, especially in terms of justice. The poor spend all of the income that they receive. The middle class spends most of theirs. On the other hand, someone with $10 million or $50 million or $1 billion of income generally spends only a small part of their income. The poor and the middle class would thus pay a much higher effective FCT tax rate under STR as a share of their income than do the rich.

The poor will be taxed at a 30% FCT rate on most of their income, since they spend all of it (although they will be protected by the rebate from the FCT impact). A family with $100,000 of income would pay an average tax rate of between 20% - 30%, depending upon their ability (and willingness) to save. A family with $1 billion of income and $20 million of consumption would only be paying an average tax of much less than 1% of their income. Any tax system that taxes the poor and middle classes at much higher rates than the ultra-wealthy is very regressive. That is very unjust!

America prides itself upon being a meritocracy--success and reward are based upon merit. That is the philosophy of Sensible Tax Reform, but not of much of America’s current tax code.

STR will make it easier for many more people to become very wealthy. Unspent income (savings) will not be taxed and can therefore be productively saved and invested. However, at some point, if an individual’s annual income rises above $500,000, the income above that level should be taxed. Such taxation is needed for America’s social, economic and political health in order to slow the rate of growth in the very big wealth gap in this country. And the revenue from it will help to keep the federal consumption-tax rate lower than would otherwise be necessary.

While many of the wealthy acknowledge their debts to America and the American people, there remains a significant group who think that they should be exempt from federal (and state) income and estate taxes. They would like us believe that it is just that they should have no income or estate-tax obligation at all--even if their income exceeds billions or if they inherit tens of billions of dollars. [Leona Helmsley, the infamous “queen of mean” who married into her fortune, notoriously said: “We don’t pay taxes--only the ‘little people’ pay taxes!”] That mentality is inappropriate for America--and very dangerous.

In addition, the income gap and the wealth gap in this country are growing very rapidly. This is increasing economic tensions, social tensions and political tensions. Of special concern is the political influence of the ultra-wealthy who wield a very strong influence on our national and municipal governments. We are risking the creation of a plutocracy--an economic aristocracy. That would be a very dangerous form of control by the few--a sharp turn away from democracy.

In America, we have an unparalleled environment for individuals to amass great wealth. The hundreds of thousands who have become wealthy through their own efforts deserved the right to do so. However, they did not earn their wealth in a vacuum. There is nowhere else on the face of the earth where so many could amass such enormous wealth in such diverse fashion as here in the United States. America’s unique environment made that wealth accumulation possible. Those fortunate few have an obligation to share with the rest of this great country some of what they have received.

There is nothing wrong with the ability of Rockefellers, Fords, Mellons or Astors to successfully maintain their wealth for generations. Indeed, they and many other dynasties have been able to do it successfully even with our current federal tax system. However, taxation of very high incomes stresses that the very wealthy have social obligations. And inherited wealth should be taxed--just as any other income is taxed.

Even with the retention of a tax on very high incomes, most of the rich will pay lower taxes than they do now, without the need for the very complicated and expensive tax planning and maneuvering that is often necessary under our current federal tax system. However, they will be paying their fair share to America under Sensible Tax Reform.

America needs a simple-and-just income tax on very high incomes--primarily for justice. However, it will also be needed for revenue and for social and political safety. There is no way that a sales tax only, one that exempts very high levels of income and wealth transfer from any income-taxation at all, will ever gain the support of moderates and liberals. Without their support, the consumption tax will never become law.

Back to Top(2) What is the personal income-tax component of Sensible Tax Reform ?

STR includes a simple-and-just income tax on very high incomes. The calculation of the income tax will be very simple:

- All income from whatever source is totaled.

- Then $500,000 is excluded--no one will pay any tax on their first half million dollars of income each year.

- Unlimited financial deductions for charitable donations will be permitted.

- Thus, only total annual income greater than $500,000 plus all financial donations (net taxable income) will be subject to any income tax.

- Fewer than 1% of Americans will be subject to the income tax.

Net taxable income = (Total income) - ($500,000) - (charitable donations)

As with all other parts of Sensible Tax Reform, everone will be treated exactly the same. No one will have special benefits that others do not have.

Back to Top(3) What counts as taxable income under Sensible Tax Reform?

All income, from whatever source, will be counted as income, and treated the same. No form of income will be tax exempt or be taxed at preferential or penalty tax rates. Salaries and wages, commissions and tips, interest and dividends, capital gains and bonuses, rents, alimony and inheritance will all be treated alike. All of the income, from whatever source, will also be equally subject to the $500,000 annual income exclusion, as well as the unlimited charitable-donation deduction. All remaining net taxable income will be subject to a very simple three-level income tax system (see below).

Back to Top(4) Under existing tax rules, dividends and capital gains are taxed at no more than half of the tax rate that applies to other sources of income. Why will they not be given the same preferential treatment under Sensible Tax Reform?

Under our current tax system, dividends are distributed by a company from income remaining after income taxes have been paid. Any dividends that are paid will then generally be taxed a second time--by the recipient. In order to remedy this double taxation, a very favorable maximum tax rate of only 20% has been bestowed upon dividends.

It would have made great sense economically to make dividend payments tax deductible to the company and taxable to the recipient. However, Congress chose to give the deduction to the recipients of the dividends--but not all recipients. Only those who receive dividends outside of tax-sheltered investment accounts, such as IRAs and 401(k) retirement accounts, receive the preferential 20% tax rate.

Under Sensible Tax Reform, since businesses will pay no taxes, dividends will not have been taxed at the corporate level. For the stockholder, dividends will be paid pre-tax by the company. Double taxation will not exist. For the recipient, the dividends will be treated the same as all other sources of income. All dividend recipients will be treated alike.

Under current rules, capital gains are also given the same very preferential 20% tax rate as are dividends. That special treatment is based upon the somewhat dubious argument that there is also double taxation involved in capital gains. Even if the argument were valid, which is much less defensible than for dividends, there are other very favorable rules which already greatly reduce the incidence of normal tax rates on capital gains. First, capital gains are generally not paid annually but can usually be postponed to a time of the taxpayer’s choosing. If the gains are from the sale of a house, up to $500,000 of the capital gains are tax deductible. [And that benefit can be earned multiple times by the same family.]

The benefits from such rules overwhelmingly benefit the wealthy who receive the vast bulk of capital gains. Under STR, all income, including capital gains, will be treated the same. Also, all groups of taxpayers will be treated alike.

Back to Top(5) How is the withdrawal of savings treated under Sensible Tax Reform?

Savings which already exist at the time that STR goes into effect (i.e., savings under current tax rules) will be treated in an analogous fashion to what is currently done. Savings which are not tax-sheltered (for example, Roth IRAs) were made with after-tax income. The original investment will have already been taxed and will remain exempt from new income taxes. However, any future income (whether dividends, interest or capital gains) from that investment will be included in annual taxable income in the year paid.

Savings that were in tax-sheltered investments (for example, an IRA or 401k) will still be taxable when STR begins. Taxes will be phased-in during a five-year transition period for all of STR in order to minimize the difficulties of changing to the new tax system.

Under Sensible Tax Reform, there will be no need for tax-sheltered accounts, since $500,000 of income will be completely excluded from an individual’s income taxes every year. Savings which have been tax-sheltered under current tax laws have not yet been taxed. All income from those investments, including capital gains, along with the principal will be included as part of annual income when received.

Savings which are made after STR goes into effect will not generally have been taxed. As with pre-STR tax-sheltered income, any gains received (e.g., interest, dividends or capital gains) will be included in the taxpayer’s taxable income for the year in which it is spent. Therefore, the gain from the investment will be included as taxable income, but the original investment will not.

Back to Top(6) How would Sensible Tax Reform affect deductions for mortgage interest payments and property taxes?

Other than charitable donations, there will be no deductions from income under STR. One of the worst aspects of the current Internal Revenue Code is its complexity. Part of its complexity is the inclusion of deductions and credits. No matter how laudable the motivation might be, it does not warrant being included in the tax code. Sensible Tax Reform will be simple--very simple. Except for charitable giving, there will be no deductions. Since the taxpayer has a $500,000 annual income exclusion, there is no need for additional deductions or credits.

Back to Top(7) How would Sensible Tax Reform affect tax credits?

Like existing tax deductions, many credits have been imposed upon the current federal tax system. Like the deductions, some are laudable while many are very questionable. In any event, they do not belong in our tax system! Tax credits will not be part of Sensible Tax Reform--Simple, Just and Effective.

Simplicity in taxation is very important. If the government wishes to subsidize some behavior (for example, energy conservation or home ownership), then it should be done openly, honestly and everyone should be treated alike in its application. It should not be hidden in the tax system, with most of the benefits going to the very wealthy as occurs today.

Back to Top(8) What would our tax-compliance obligation be under Sensible Tax Reform?

98% of taxpayers would have no annual obligation at all. Only those with very high annual income would even need to file their annual taxes. For the rest of us, there will not even be a need to keep extensive financial records for three years or more. There will be no fears of IRS audits and penalties. 98% of taxpayers will be totally exempted from this agonizing annual income-tax ritual on April 15.

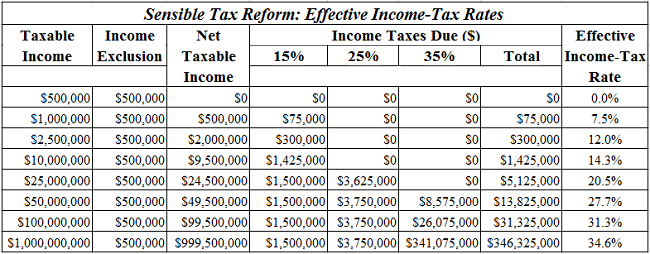

Back to Top(9) What would the income-tax rates be under Sensible Tax Reform?

There will be only three income-tax rates. After the $500,000 income exclusion and the deduction for charitable contributions, the remaining income will be taxable. The first $10 million of net taxable income will be taxed at 15%. [Under current federal tax law (for 2016), the 15% rate applies to a family at $18,550 of income.] Net taxable income between $10 million and $25 million will be taxed at 25%. [Under current federal tax law, the 25% rate kicks in at only $75,300 of income.] Annual net taxable income greater than $25 million will be taxed at a rate of 35% [whereas at present the 35% applies to income as low as $413,350].

For example, a corporate president with $6 million of income and $2 million of charitable donations would only pay an effective taxe rate of 8.75%:

| Total Income | $6,000,000 |

| (-) Charitable donations | ($2,000,000) |

| (-) Annual income exclusion | ($500,000) |

| = Net taxable income | $3,500,000 |

| *15% = Taxes due = | $525,000 |

Likewise, someone with $200 million of income and $30 million of donations

| Total Income | $200,000,000 |

| (-) Charitable donations | ($30,000,000) |

| (-) Annual income exclusion | ($500,000) |

| = Net taxable income | $169,500,000 |

| Taxes due | |

| $10,000,000 at 15% | $1,500,000 |

| $25,000,000 at 25% | $4,237,500 |

| $134,500,000 at 35% | $47,075,000 |

| $52,812,500 |

The effective tax rate would be 26.4%. The very wealthy would no longer have preferential, complicated, expensive and often economically-irrational tax loopholes. Many would pay more income taxes than they do now. Sensible Tax Reform--Simple, Just and Effective would treat all taxpayers alike. Very high incomes will still occur, but tax justice will have returned at last to our tax system.

The following table illustrates both taxes that would be due and the effective income-tax rates for various levels of high income. [Charitable donations would, of course, reduce both numbers.]

Back to Top

(10) Some individuals are able to borrow money to spend. How would that be taxed?

Borrowing is not taxable income and not subject to income taxes in that year. However, the spending will be subject to the consumption-tax rules.

Back to Top(11) How would illegal activities be affected by Sensible Tax Reform?

Under our current federal tax system, most of the income of drug dealers, the mafia and others who obtain money illegally evades federal taxation. Under STR, we would still be unable to tax the income, but we would tax their consumption--at the FCT tax rate of 30% on most of their spending.

Back to Top